The December holiday rush has revealed a divergence in the Champagne market, with prestige cuvées holding value while "entry-level" luxury brands see volume declines. Champagne market analysis for December 2025 shows a shift from big brands to rare vintages and grower labels.

LVMH and other major houses reported a 12-15% revenue dip in their Champagne segments this month. However, this isn't a lack of interest, but a shift in taste. While Moët & Chandon volumes are under pressure, ultra-rare allocations like Salon S 2012 and Dom Pérignon 1990 (recently featured in major December auctions) are seeing record-high interest from US private collectors. The "Grower Champagne" movement also reached a new peak this month, representing 20% of high-end NY retail sales.

Why Collectors Should Care:

-

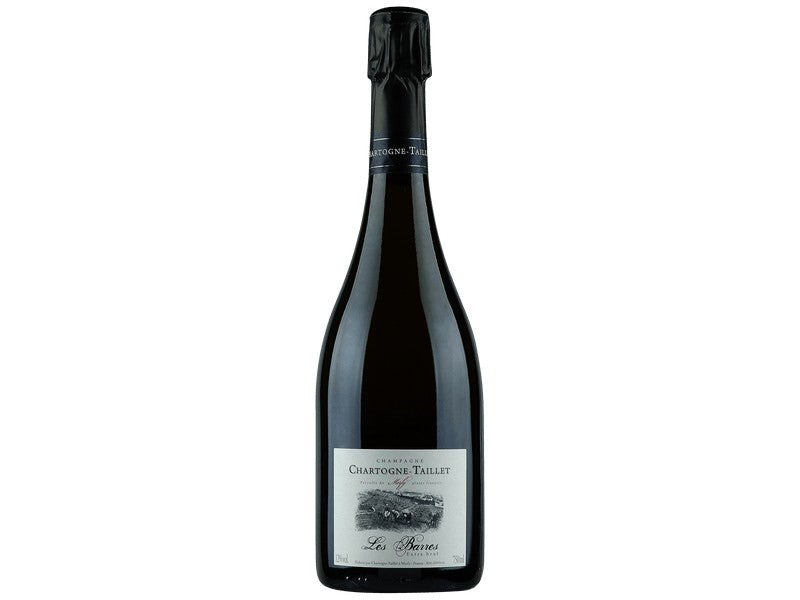

Investment Shift: "Brand" power is slightly weakening in favor of "Terroir" power; limited-run grower Champagnes are appreciating faster than mass-market luxury labels.

-

Back-Vintage Gold: Mature Champagne (1990s, 2002, 2008) is currently the most stable sub-sector of the entire French wine market.

-

Buying Opportunities: Weaker demand for standard NV (Non-Vintage) Champagnes may lead to retail discounts in the US during Q1 2026.

-

Collector Preference: US buyers are increasingly targeting low-dosage and biodynamic producers (e.g., Agrapart, Selosse).

Source: LVMH Q4 Interim Report, Wine Auctioneer December Highlights, Bloomberg Luxury Index.

Art: Grok AI