The fine wine market recovery accelerates in December 2025 as the Liv-ex 100 rises for the third month, led by French blue-chips. The secondary market for blue-chip French wines has officially broken its 36-month losing streak, marking December 2025 as the third consecutive month of growth.

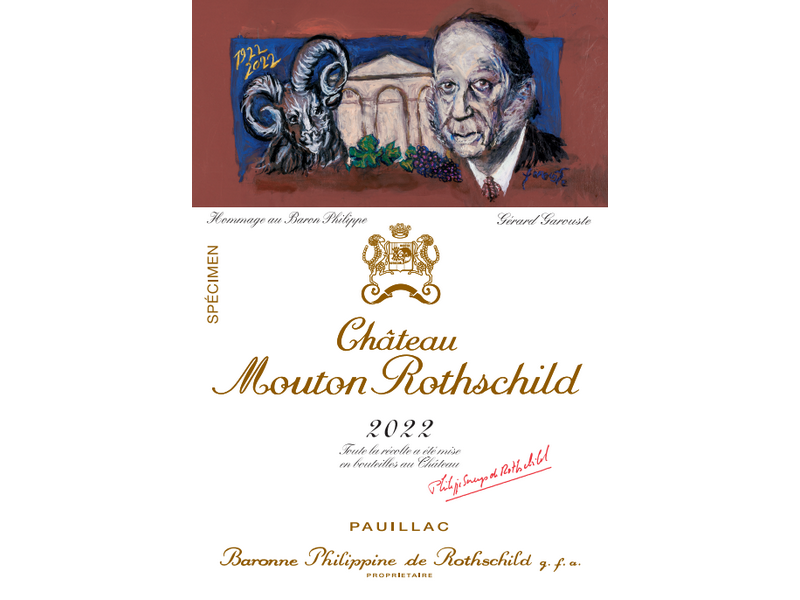

The Liv-ex Fine Wine 100 index rose by 0.9% in the first half of December, a move supported by a significant return of US liquidity. While the market remains roughly 25% below its 2022 peak, the "bottom" appears firmly established. Bordeaux and Burgundy led the trade, with Château Lafleur 2019 performing as the month’s top asset, surging +20% in value. Other "Right Bank" estates and iconic labels like Château Margaux 2015 also saw steady gains of 2–4%.

Why Collectors Should Care:

-

Confirmed Bottom: Three months of growth suggest the multi-year correction has ended, opening a "buy" window before 2026 appreciation.

-

Bordeaux Resilience: Right Bank wines (Pomerol/St. Emilion) are showing the highest price elasticity and demand right now.

-

US Market Influence: Increased bid-to-offer ratios from US-based collectors are the primary engine behind this month's recovery.

Source: Liv-ex Market Report Dec 2025, Vinum Fine Wines Market Report, Wine Investment Magazine.